eCommerce 202: Brass Tax

In response to the dynamic market shifts the last year presented, wholesale dealers are seeking new and innovative ways to compete with mega-businesses such as Walmart or Webstaurant. For some dealers, selling equipment online has become a viable and profitable solution. An eCommerce store is capable of handling major sales logistics such as payment processing, shipping rates and state sales tax.

Wholesale dealers new to eCommerce may not realize how broadly they expand their sales zone when opening an online shop. Anyone in the United States can view and purchase from a public eStore so dealers must consider the possibility of long distance and remote sales.A major factor often overlooked by online sellers is state sales tax – now that the sales pool has broadened in area, there are new tax laws that must be abided to protect your company from economic tax nexus.

Nexus describes the amount of presence a company has in a location, such as a city or state.

Economic nexus refers to the dollar impact a business has on a particular area.

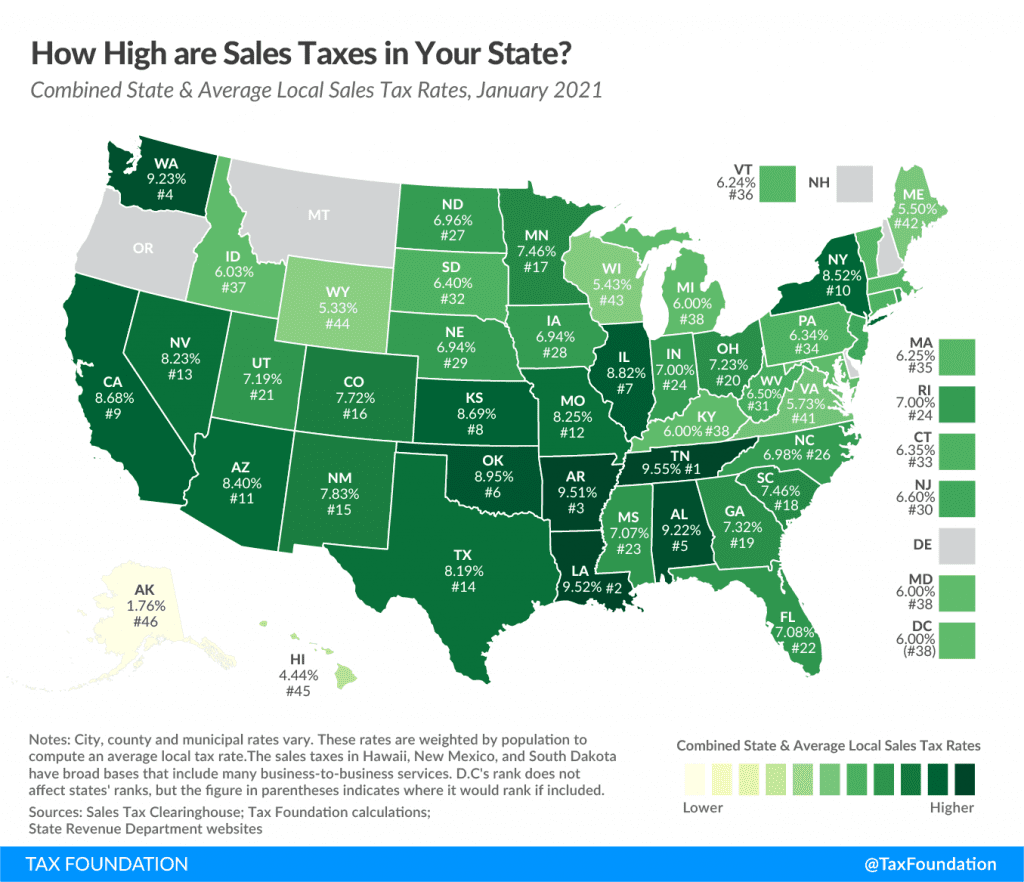

Online sellers may have enough economic nexus to be liable for Sales Tax Nexus. Sales tax laws vary state by state which poses a risk for sellers remotely distributing products and unknowingly under or over collecting on sales tax.

Forty-five states and Washington D.C. collect sales tax and on top of that, most states also allow “Special Taxing Districts”, primarily in big cities, that may collect additional sales tax on top of the state tax.

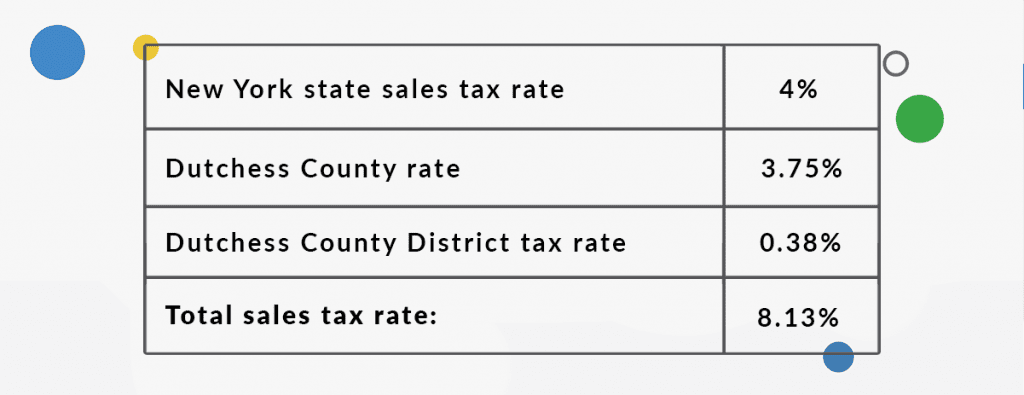

Rhinebeck, New York is an example of a local area that has an odd amount of combined sales tax.

Generally, states consider two factors to determine if a business qualifies for sales tax nexus: in an area:

Dollar total of purchases in an area.

Number of transactions within an area.

Major changes have occurred to state tax regulations since the 2018 U.S. Supreme Court case, South Dakota v Wayfair, Inc. where the court ruled in favor of the state. Wayfair, Inc. is an online store based out of Boston that failed to collect state sales tax based on the pretense that they are not a physical presence in any state other than Massachusetts. South Dakota responded to this regulatory ambiguity with a Supreme Court case that resulted in the overruling of a longstanding physical presence law.

The risks of poorly managed state sales tax calculations can range anywhere from hefty monetary penalties to serving time in prison. Protecting your business’ finances and reputation cannot be overlooked when opening an eCommerce storefront.

Modern eCommerce stores have the power to track and collect state sales tax across a wide geographical range programmatically with solutions such as Avalara or TaxJar.

When integrated properly with your website, these applications will reduce the complexity and struggle of tax regulation compliance. Building an eCommerce website with Beedash means you get our website expertise and a consultation with our Sales Manager to determine the best eCommerce integrations to suit your business’s unique goals and needs in the online marketplace. If you are interested in learning more about sales tax solutions to support your remote sales, contact Beedash today!

Beedash has a partnership with Avalara and may receive commission through referrals.

Have a Request for a New Feature?

Feel free to let us know at anytime which features you’d like to see in Corestack Product Information Manager. You can submit a feature request using our Corestack Service Desk’s Feature Request form linked below.